Unsecured business loans are smart choices to consider

Unsecured loans offer entrepreneurs a choice to make smart decisions based on their situation.

Daymond John: Millennials lead in smart business technology

Pakistani economy cuts deficits in half in 2015

Android MOTO 360 2nd Generation review: A premium design

Whether you are thinking of starting a new business or expanding one, unsecured business loans would be a wise choice to consider. As we all agree, funding is one of the most critical drivers for any business to thrive. Traditional banks and online financial institutions compete healthily in 2016, which benefits entrepreneurs. This encounter means alternative finance could make lending rates lower than in earlier years.

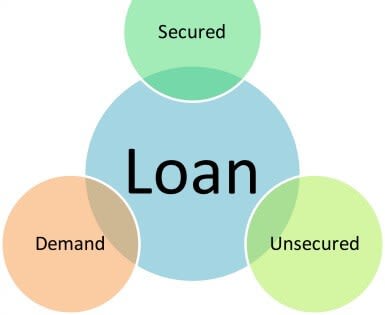

As entrepreneurs and startup businesses emerge, demand for loans is also at its peak. Institutions like Kabbage, RapidAdvance, and Accion have made small business financing easier. Non-traditional banks are providing business capital for startup projects at lower loan rates. These third-party financial businesses offer secured loans and unsecured business loan options.

Average rates on unsecured business loans were higher than secured ones in the US by the end of 2015. High rates are common in unsecured business loans because of the lack of collateral.

What is an unsecured business loan?

One of the easiest business loan alternatives is the unsecured business loan. With an unsecured business loan, collateral isn't necessary. It's approved based on the borrower's creditworthiness rather than any collateral or property.

Borrowers should have very high credit ratings to be approved by a line of credit. They are also called signature loans or personal loans. Acquiring a credit card is a good example. Unsecured business loans do not require collateral, which suggests lenders take risks in granting them. Therefore, interest rates, sometimes, could be high. As the sole proprietor of a business, an unsecured business loan is an easy option to consider. In other cases, the interest rates on unsecured business loans have a fixed APR.

When to consider unsecured business loans

A third-party loan can help you start a new business or expand an existing one. Working capital loans has increased the rate of startup projects and has improved business expansions. Unsecured loans continue to strengthen business finance solutions. Entrepreneurs without collateral can use it instead of business startup loans. We should always keep business ideas alive! Funding business without collateral is also great, but has its negatives and positives.

Advantages of Unsecured Business Loans

Unsecured business loans are easier to get because you don't need collateral.

Lenders can’t seize any of your business property.

If you have gained an unsecured business loan, but the business is not going as planned, you could file for bankruptcy. The court most likely will relieve you from paying back the loan.

Disadvantages of Unsecured Business Loans

Unsecured business loans have higher interest rates than secured loans.

It is challenging to get an unsecured business loan if you don’t have good credit.

Missed payments on unsecured loans can affect your business credit rating. It is, therefore, imperative to keep track of payments as a positive way to improve your creditworthiness.

Enoch Antwi

Enoch Antwi is the managing editor at The Business Frontal. He worked as a business and an environmental journalist in the late 1990s with the Business and Financial Times. His passion is to provide on-demand valuable information and insights on business, entrepreneurship, leadership, innovative technologies, and principles for corporate success in today's business world.