Options improve business and investments, says Warren Buffet

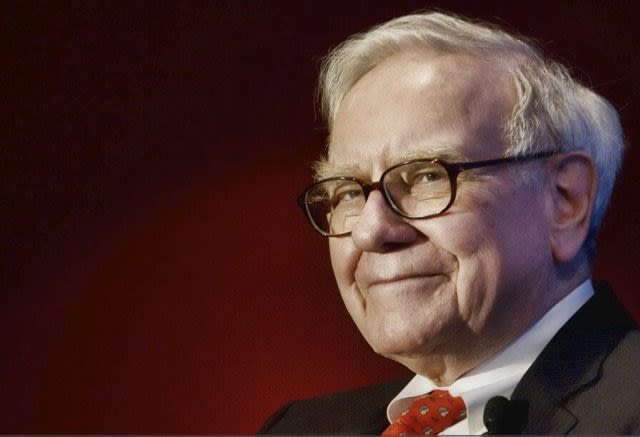

Warren Buffett is an investment giant whose net worth is over $70 billion. He shares secrets on investment principles.

Daymond John: Millennials lead in smart business technology

Pakistani economy cuts deficits in half in 2015

MOTO 360 2nd Generation review: A premium design

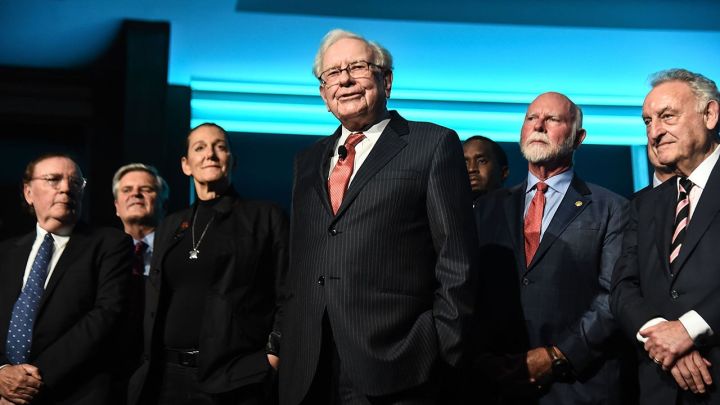

Warren Buffett continues to achieve business excellence. His views on investing in stocks have made him an investment guru. From business fundamentals, taking risks, and being consistent, he shows moral judgment for having options in your portfolio to improve business and investments.

As one of the world’s most successful and wealthiest investors, Warren Buffett was born on August 30, 1930, in Omaha, Nebraska. He was the only boy in a family of three children. Warren had a well-off family that supported him, but his hard work, perseverance, and wisdom have made him who he is today.

During his teenage years, Warren Buffett was very much interested in making money, so he rented out 40 acres of land for a profit. His father wanted him to study, and he got admitted to the University of Pennsylvania. After two years on campus, he changed schools. He later got into Columbia University and completed his degree.

Warren Buffett: His net worth is over $70 billion

Warren Buffett, through his knowledge and business principles, has gained a fortune that accumulates to more than $70 billion. This is because of his keen understanding of the concept of investment. Through stock diversification, business excellence, and hard work, he finds joy in his investment strategies. As he continues to tackle different areas in business, his worth and knowledge become indispensable. His investment techniques have given him authority in the investment market. Most successful people share their ideas about how they got what they have. Warren Buffett also sheds light on the elusiveness of business investment on which most people lack prime knowledge.

Having over one option in your portfolio will always enhance your chances of success.

Always know the fundamentals

Warren believes that whatever you decide to do in life, whether it’s a circular job or investing in a business, the most important thing is knowing the fundamentals. “You just have to understand the basics and fundamentals of what you do and you will gain wisdom to perfect your dreams,“ he said.

The business leader is of the view that success is achievable, but having a fundamental wisdom in your trade changes the course of your business. “You can only make progress with the knowledge you gain about your business,” he stressed. He explains that poor judgment often occurs with less understanding, but success comes through consistent study and observation.

Having options improve your chances of success

In the eyes of Warren Buffett, having over one option in your portfolio will always enhance your chances of success. If you are not doing so good in your one area, you can feel safe knowing that you have something else to fall back on.

Warren Buffett explains there is always a risk in business as we persevere for success. "We must see risk as both friend and foe. Having the courage to take risk will determine how you will do in your coming years. Risk-taking is tricky. Sometimes taking risks will take your business to the heights of success or it could also harm for your business," he affirmed.

Warren Buffett believes you should always decide how much risk you take at a time. As you take stock of your progress, you venture into new investment territories.

Be consistent in everything you do

Warren Buffett quotes the success of Berkshire by saying that to become successful in any industry, you must have a better strategy than your competitors. Have a full grip on the fundamentals of the business, and don’t look back. Just carry out those principles consistently until you have what you want. You should always be certain that you will have success someday. “It’s only a matter of time, which again requires consistency," he concluded.

The Editorial Staff

The Editorial Staff at The Business Frontal is a team of writers dedicated to bringing seasoned news stories and how-to business articles to our readers and patrons to help maximize their entrepreneurial potentials.

More from Business Executives

Richard Branson defends five business principles

Marilyn Tam recommends 10 ways to live your dreams

Jeff Bezos provides tips on how to build a better work culture

Bill Gates predicts the next 15 years in innovative technology

Raise your standards and change your rituals – Tony Robbins

Five C’s of leadership—Indra Nooyi

Strategic access to customers appreciates capital investments

Reid Hoffman shares entrepreneurship guidelines

Michael Bloomberg: Failures provoke business success

Daymond John: Millennials lead in smart business technology

Mark Zuckerberg: You win by being faithful to your purpose