Gas reserves in the U.S. have become industry’s windfall

The US market lead in the recent substantial gas reserves has created opportunities for lower-cost conversions to liquid fuels and chemicals.

Daymond John: Millennials lead in smart business technology

Pakistani economy cuts deficits in half in 2015

Android MOTO 360 2nd Generation review: A premium design

The U.S. market lead in a recent substantial increase in natural gas reserves from shale oil drilling and fracking has created opportunities for lower-cost conversion to liquid fuels and chemicals.

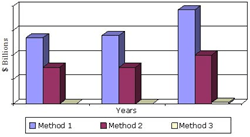

In a press release, BCC Research announced that they project products produced by gas-to-liquid (GTL) processes to reach approximately $5.6 billion in 2015. Experts expect the market to grow at a rate of approximately 6.6% from 2015 to 2020.

According to the new report from BCC Research, the appraisal of products produced by GTL, coal-to-liquid (CTL) and biomass to liquid processes was worth $8.4 billion in 2014. This is expected to grow from $8.6 billion in 2015 to $11.8 billion in 2020.

Many major oil companies have announced plans to investigate the production of synthetic diesel fuel via a GTL process. A handful of established GTL companies, such as Sasol, Shell, PetroSA, Chevron, and Renewable Energy Group, however, are the dominant producers. There are many second-tier companies that have sizable GTL support operations in engineering, design, plant construction, ancillaries, and related activities.

Liquid GTL products are primarily transportation fuels, which are defined as synthetic fuels or synfuels, as well as chemical feed-stocks such as methanol, hydrogen, and other petrochemicals. The petrochemical industry presently uses the terms GTL and GTL products to refer to the output of plants or refineries that use stranded natural gas as feedstock.

The GTL business is involved in the chemical conversion of stranded natural gas feed-stocks to products such as transportation fuels, lubricants, and chemicals. As far as beneficial processing of the world’s vast resource base of stranded natural gas is concerned, GTL processing is a relatively recent research and development focus of the petrochemical industry.

World Bank estimates natural gas wastes

"The World Bank's estimate states that companies annually flare or vent over 150 billion cubic meters of natural gas, amounting to approximately $30 billion and equivalent to one-quarter of the U.S. annual gas consumption. All of this wasted resource is potentially available to GTL processing,” says BCC Research analyst Kevin Gainer. “The current strategy in GTL technology is focused on monetizing this huge amount of otherwise worthless remote natural gas deposits,” he added. Natural gas supplies have become even more plentiful of late, thus making gas a potentially low-cost feed-stock for manufacturing fuels and chemical raw materials.

The report also describes how recent breakthroughs in conversion technology, including notable developments in small-scale GTL production, have made GTL products competitive with products refined from crude oil.

BCC Research claims the company publishes market research reports that make organizations worldwide more profitable with intelligence that drives smart business decisions.

Photo Credit: Bloomberg (Image of CEO John S. Watson of Chevron)

Enoch Antwi

Enoch Antwi is the managing editor at The Business Frontal. He worked as a business and an environmental journalist in the late 1990s with the Business and Financial Times. His passion is to provide on-demand valuable information and insights on business, entrepreneurship, leadership, innovative technologies, and principles for corporate success in today's business world.

More from Business News

Business leaders predict global economic uncertainty

Venezuelan entrepreneurs kickback on branding setbacks

Cryotherapy to overcome advanced stage kidney cancer

Small business loans: ReadyCap appoints seasoned hires

Pakistan completes CPEC motorway project